Never let a good crisis go to waste: 5 implications of FTX scandal

Wow, what a couple of weeks in cryptoland! FTX, the crypto exchange with some of the closest relationships with US politicians, US regulators, US VC investors and institutional traders experienced a bank run, halted withdrawals, uncovered scandalous fraud and filed for bankruptcy, leaving black cloud and endless questions in its wake.

Here are my 5 Implications of the FTX debacle:

FTX's shocking unravelling shows us that deception is alive and well amongst crypto users but says more about human nature than crypto technology. Bitcoin and ethereum are down in price but the networks are functioning robustly, transactions are being processed and no on-chain frauds are underway.

Fractional reserve banking is the proverbial drug of finance and it enables frauds to become bank crises, which is what transpired at FTX in 2022. This problem is far bigger than FTX's audacious fraud. The failure and Celsius, Voyager, Celsius and numerous banks in the history of traditional finance can be put down to fractional reserve banking.

Many will call for severe regulation post FTX, but banking regulation is potentially difficult and ineffective in crypto. This does not mean that regulation cannot play a positive role but we must be cautious of thinking that it is the silver bullet. Badly thought out regulation could have the opposite impact to desired.

Central banking 'prevents' banking crises in trad-fi but is technically impossible and undesirable in crypto. Sharp business cycles are the norm in crypto. They are painful but they root of the problems, leaving the industry on a stronger footing thereafter.

The primary principles of crypto solve the FTX debacle and many others in finance: decentralization, censorship resistance, immutability and verifiability. Crypto needs to impose these principles on centralized intermediaries through self custody, utilization of decentralized exchanges and implementing proof of reserves.

I put a series of videos where I expand upon the background to the FTX saga, the role of fractional reserve banking and the ways in which we solve this crisis. As Winston Churchill was want to say, "never let a good crisis go to waste".

Technology is robust

As you will gather from my note last month, I did not predict this collapse of FTX. I thought conditions were getting more constructive in October. It hurts and its embarrassing to have missed this scandalous fraud. But as I have said before, FTX does not reflect on crypto technology. Anyone who says otherwise, does not understand the technology.

Pain galvanizes people to return to principles

While it hurts, the deeper the crisis gets the more excited I become because there is a firm impetus to return to the foundational principles of crypto. Those principles make this technology valuable. A web of centralised intermediaries merely replicates the existing problems in trad-fi. Its a good thing that crypto expunges these frauds from its ecosystem.

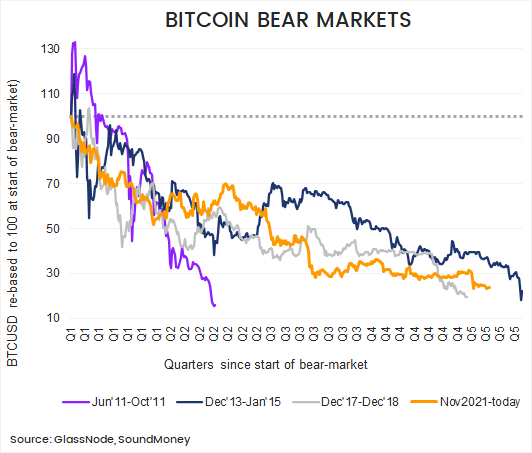

Painful Bear Market, similar to the past

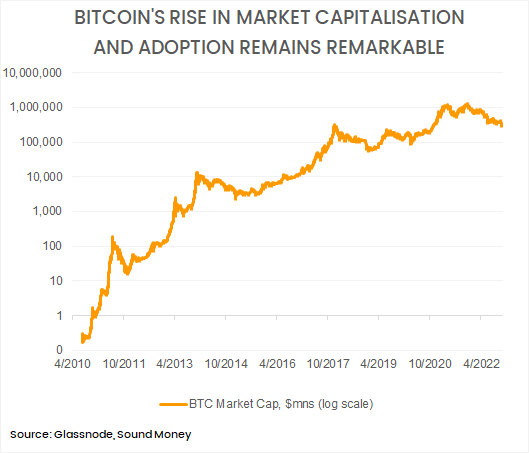

Bitcoin has painfully declined 78% since its October 2021 peak. It also fell 92% in 2010 and 2011, 85% in 2014 and 2015, and 83% in 2018. None of these crashes hampered its functionality or the rapid pace of adoption of the related technology. In fact, crypto has advanced during each subsequent cycle and its adoption rate is among the fastest of any technology.

Reaction muted relative to news & extreme sentiment suggests bottom Close

The price response to the FTX debacle has clearly been sharp. However, the move has been muted relative to the degree of the crisis. This suggests that forced sellers remain few and far between. This aligns with our own research, which motivated our confident assessment ahead of the FTX shock. With bitcoin's detractors jumping on its grave, sentiment is approaching the most bearish I have ever seen. Even the economist, is jumping! If its not already in, the bottom is very near.

Happy Thanksgiving to those of American heritage

I am deeply grateful to be working on ideas, principles and solutions I am passionate about, and which I expect will have an increasingly positive impact on the world in the years ahead.

Questions, comments and additions are always welcome.