2023 OUTLOOK: SOMBRE OPTIMISM AMIDST DEPRESSED SENTIMENT

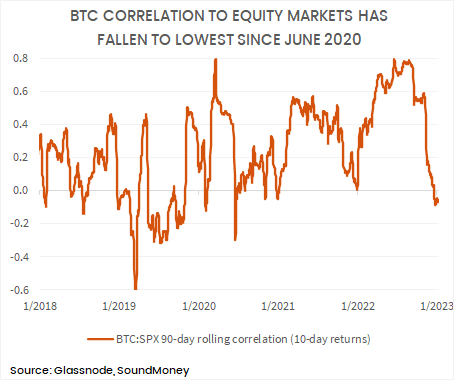

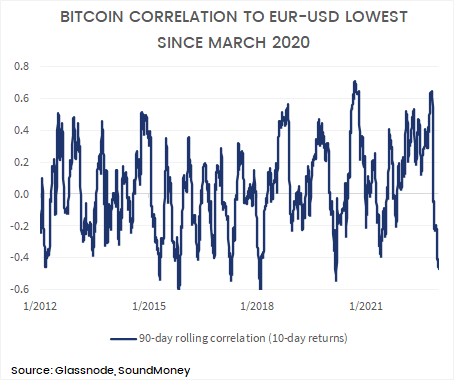

With bitcoin and Ethereum down 65% and 68% respectively over the past year, reflecting on 2022 was testing. Looking back to my 2022 predictions they highlight the challenges of the past year and provide several great lessons. Crypto is as susceptible to the vagaries of the global liquidity cycle as ever, pushing bitcoin into the 4th prolonged bear market in its 14-year history. Bitcoin internals suggest that the bear market is over, correlations vs. trad-fi have broken and sentiment is incredibly depressed, which supports a counter-trend upside surprise in price. But the depth of the liquidity winter remains a question mark, which must keep risk appetite somewhat constrained in 2023, or until the liquidity cycle turns. TDLR: A challenging 2022 is expected to give way to a choppy but upside biased 2023 with bitcoin and ethereum surprising to the upside.

…skip ahead…

2022 Review: Value-add & Lessons in the face of challenging conditions

Let's start with the predictions from the 2022 outlook that played out as expected:

In Jan 2022, I foresaw a challenging year ahead and expected a >50% correction in crypto. We were able to add value to clients under these conditions, for which I am grateful.

I was correct about the increased focus on environmental impact of PoW and was compelled to put together a video in October 2022.

The Merge was executed as expected, and ETH shifted to PoS, further differentiating BTC from ETH.

The Merge triggered off a healthy debate about censorship resistance and decentralization, which is another conversation I foresaw at the start of the year.

On the more challenging front here are my reflections on the other predictions:

Bullishness counteracted through enhanced investment process and risk management framework

In January 2022 I said that my 2021 expectations were too bullish, and I did it again in 2022. I was still too bullish looking into 2022. On reflection, this does not surprise me. I am biased towards a bullish outlook on bitcoin because of the profound positive role it can play in society. I am comfortable with this bias because I expect it will result in outsized long-term returns. In the shorter-term, I expect that I am better able to counteract this bullish bias in 2023 through an enhanced investment process and risk management framework.

Crypto leverage accounted for through BTC & ETH dominance

In January 2022, I lowered the probability of an extended bear market (effectively ruling it out) because BTC did not get very frothy in 2021. This was an error in judgement. The reality is that Bitcoin is the base layer of crypto and is intertwined with the rest of crypto markets. I underestimated the froth and leverage within broader crypto and the feedback into bitcoin. The same leverage nonsense was taking place as it always does during each global liquidity cycle. This time was NOT different.

I have corrected for this error through increased focus on BTC dominance, which I see as a reasonably simple and accurate reflection of the degree to which the crypto markets have leveraged on top of bitcoin’s base layer. To counteract a bitcoin bias, I also look at a combination of BTC and ETH dominance. There is little doubt that ETH is the second most dominant cryptocurrency network. ETH serves as the settlement layer for most smart contracts, Defi and NFTs. Higher BTC & ETH dominance combined is also a sign of greater sensibility in the crypto markets vs. lower BTC & ETH dominance, which is reflective on capital flowing into much more speculative and centralized projects.

Greater emphasis on macro indicator

I underestimated the impact of the trad-fi macro cycle on crypto. I have corrected for this placing greater emphasis on our macro indicator (we cover macro in more detail in the 2023 outlook).

Patience is a virtue

I underestimated the Fed's desire to tighten policy. While Fed policy is still effectively loose because real interest rates are low, inflation is high the Fed has created positive real interest rates in the bond market. I overestimated the speed of the impact of Fed tightening on trad-fi and as a result the speed at which the Fed would respond. In reality, it takes a while for the market to fully price the impact of the tightening and thus to pressure the Fed to change course. I needed to be more patient and sit while these cyclical headwinds were working their way through the markets.

Where to from here? 2023 outlook

Bitcoin bottom is most likely complete

The current length of this bear cycle from October 2021, measured in time, compares with previous cycles. If we hit a new cyclical price low in 2023, it would be the longest BTC bear market in history. Depth of this bear market is not quite as deep as previous bear markets, but it is certainly in the ballpark.

If BTC has bottomed, moderate performance in the first 6 months of a bull-market is normal. Historically, the "worst case scenario" was moderate bitcoin performance for 3 quarters after the price bottom.

BTC tends to bottom between 9 and 11 quarters after the halving cycle (when bitcoin supply growth is cut in half). If we have bottomed, it will still be the longest period after a halving before a bottom.

We are 5.5 quarters away from the next halving (May 2024). BTC tends to bottom at least 4 quarters before the halving.

On-chain net realized losses are similar to previous bear markets in time and quantity.

Price has spent a significant amount of time below realised price (which is the price at which the average bitcoin was last moved) and a comparable amount of time to previous bear markets.

Price is currently close to the cumulative value of coin days destroyed. This measure adds additional weight to the length of time since coins were last moved.

Long-term holders have not been shaken by the FTX debacle. 58% of bitcoins have not moved in 12 months, one of the highest readings on record.

One could argue that current trad-fi conditions are more challenging than that which we have experienced since bitcoin’s emergence in 2009. Perhaps we have entered a new macroeconomic regime and this bear cycle will be more extreme than previous cycles? There is certainly some credence to this argument, and I will return to it again in a moment.

However, there is a risk of falling into the error of thinking “this time is different” to justify taking a view on the market that aligns with negative sentiment. We would never dispute the importance of global macro conditions on crypto, but the correlations to trad-fi have fallen in recent months. Bitcoin internals have a large amount of repeated cyclical credibility - they suggest the bottom has already taken place and we think there is a reasonably high probability that they are correct.

Macro conditions are improving but further confirmation required

Our macro indicator reflects that conditions are starting to improve on the back of a weaker USD and steeper yield curve. Current levels are high enough to compel us towards a more constructive price outlook.

It is worthwhile to recognize that the macro indicator rose more than previous cycles and did not fall as much as it has in the past, so another leg lower is certainly possible in 2023. Ideally, I would like to see corroborating evidence of a macro upswing from increasing money supply growth, falling inflation and declining real interest rates. These changes would confirm that we have entered a period of more supportive liquidity again.

US M2 money supply growth contracted for the first time on record at the end of 2022 so clearly liquidity is still tight. Bitcoin may have run out of major forced sellers and perhaps large amounts of sidelined cash steps in to start ticking prices higher but it is very unlikely that bitcoin and crypto enters into an extended bull-market until US money supply growth turns positive again.

The liquidity winter is also having an impact on the economy and growth sensitive commodities like oil. Brent Crude is basically flat over the past year, which will result in lower CPI in 2023. I.E. Real interest rates will rise further if the Fed does not cut or force the market to price lower yields on the long end of the bond curve. After one of the worst years on record, I expect this could be a strong year for Treasuries in the face of a challenging decade for that asset class.

In the face of extremely negative sentiment many crypto investors are worried that the regime of cheap money and low interest rates is behind us and that we may not see another crypto bull-market for many years to come. While we can never rule out a potential scenario, this appears unlikely to us. Elevated global debt levels imply that real interest rates must remain largely negative in the next decade to ensure debt monetization. I.E. Debtors must be bailed out and the value of currencies must decline to reduce the debt burden. This remains favourable for store of value assets, particularly ones with monetary qualities that serve as an alternative to the creaking monetary regime in traditional financial markets.

2023 predictions

Bitcoin surprises to the upside in 2023

Rallies above $25K,

but won't hit a new all-time high,

may retest the lows as tight global liquidity keeps risk appetite constrained,

won't hit a new cycle low below $15.5K

Major crypto regulation could be positive for industry

The SEC has been a hindrance to crypto under Gary Gensler’s leadership, but new SEC leadership is possible after FTX controversy.

Republican chief whip Tom Emmer is crypto supportive and is someone to watch in 2023.

Regulation may clamp down on securities and create greater clarity in industry.

Pain continues to be exerted on broader crypto markets.

Bitcoin & ethereum dominance rises.

Bitcoin outperforms as crypto broader use-case demand from new users remains weak.

Continued investment in crypto technology and use-cases below the surface.

Stablecoin adoption continues to grow, offering truly global money and settlement

Expect progress on tokenization of equities and bonds - imagine trading and settling SPX and TLT 24/7

Defi adoption grows

In the wake of FTX debacle, existing crypto users are being forced to consider decentralized exchanges.

The real test of decentralized principles will re-emerge during the next bull-run when new users often throw principles out of the window, preferring convenience and cost

2023 kicks off on a sombre note after the challenges of 2022, however the value-proposition for decentralised monetary and financial technology is unchanged. In fact, the re-emergence of the core crypto principles triggered by the FTX debacle reinforces the long-run trajectory. Lessons are being taken onboard and the technologies supporting bitcoin and the decentralised financial ecosystem will develop even greater resilience. Given depressed prices and sentiment, the year ahead promises to be more encouraging than 2022. Tight global liquidity will likely keep a crypto bull-market at bay until 2023 but bitcoin internals suggest that the bottom is in. We agree and look forward to the opportunities presented by the new year.