Market Review (March 2022): enhanced reserve asset credibility

Crypto specific news (Luna BTC purchases and ETH merge) drove strong BTC and ETH performance in March, but the sustainability of the rally remains in question over the coming quarters because of weak overall demand and tough macro conditions. Behind the scenes, bitcoin’s value proposition continues to grow. Each month there are signs that the global monetary system is shifting and evidence is stacking up that bitcoin has a role to play in that transition. I will be looking to make the most of the short-term rally, but I remain cautious for the coming months because a potential liquidity event remains a real risk. Nevertheless, I will remain biased towards the long-side long-term because larger nation-state purchases are not far away.

Key Insights

Bitcoin experienced another strong month, rallying from lows of $38 to $48K. The monthly gain was only 9% because we opened the month at $42K after a 14.3% rally in Feb.

The primary drivers of bitcoin strength were twofold:

Equity markets rebounded in March and bitcoin experienced a relief rally in unison.

A supply squeeze took place on bitcoin exchanges after a large algorithmic stablecoin (Terra) started buying up large amounts of BTC.

ETH gained 15.2% in March, outperforming BTC as investors priced a more buoyant outlook ahead of the merge.

Geopolitics of monetary regime change are intensifying and bitcoin has a role to play.

Trad-fi liquidity risks remain as yield curve inverts, global economy heads towards recession and BTC:S&P500 correlations remain strong

GEOPOLITICS OF Monetary Regime Change

As the dust settles from the Russia-Ukraine conflict I am increasingly convinced that we are in the midst of a global monetary regime change. Luke Gromen has been all over the geopolitical component of this transition. I recommend listening to Luke being interviewed by Grant Williams if you would like to delve into more detail on the matter. Here is my interpretation/summary:

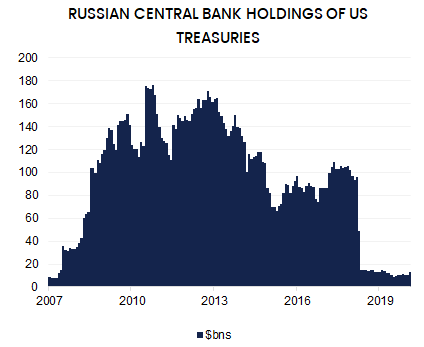

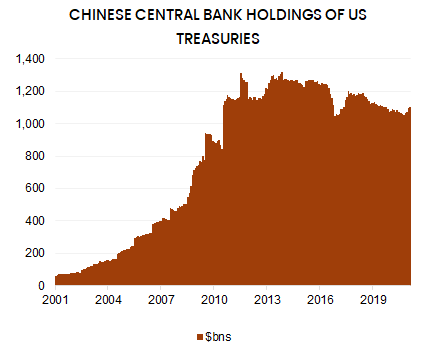

The world has been on a USD reserve currency system since the 1970s. A critical component to this system was the commitment of energy producers to sell energy in USDs and store US Treasuries in reserve, which is why the system is often referred to as the petrodollar. Ballooning US government debt, future debt obligations, zero interest rates and never-ending Quantitative Easing imply that US Treasuries are long longer as attractive as they were as a savings vehicle. This does not imply that US Treasury yields are going to spike to 10% overnight, but there is a strong incentive for countries to consider saving their trade and current account surpluses in other assets. Russia began this diversification away from US Treasuries in the 2010s and China has also stopped buying Treasuries in 2011.

Western governments decision to sanction Russia’s global reserve assets last month escalates this trend away from US Treasuries.

What are large sovereign’s going to purchase instead?

German Bunds, Japanese Government bonds, London property, the Nasdaq or the S&P500 are faced by similar challenges to Treasuries. Investors cannot self-custody these assets. So what are the alternatives? Gold, the worlds pre-1970 reserve asset, is an alternative that fits the bill. Evidence suggests that central banks have already been buying up a large amount of gold since 2008. China and Russia have been two of the leading buyers, followed by Turkey, Kazakhstan, Uzbekistan, India and Thailand. Russia's actions since the start of the war in Ukraine suggests that it wants energy and gold to play a greater role in the global monetary order after it has announced that Europe will need to pay for Russian energy in Russian Roubles or gold - effectively backing the RUB with oil and gold. Friendly countries are able to pay for energy in yuan, lira, dinar, and bitcoin.

Gold will likely remain a favoured asset by central bankers because they are already dominant in this market, but bitcoin is featuring in the conversation. It is unlikely that this implies trade will be settled in bitcoin overnight, but the fact that they are even talking about this is a big deal. And what does it imply about Russian bitcoin holdings? I am not 100% sure, but the prospect that they are buying bitcoin already is higher than zero. I spoke about Russia potentially buying bitcoin in January in Rogue State Demand?

Liquidity risks and btc trad-fi correlation

Falling global demand for Treasuries, combined with less central bank purchases and rising inflation have conspired to push Treasury yields sharply higher. However, it does not necessarily imply Treasuries are going to sell off in a straight line. The western financial system has US Treasuries as the foundational collateral asset. A shift away by Russia and China, does not change the structure of western financial system overnight. As yields rise, this creates the risk of a liquidity event in traditional financial markets, forcing capital from equity and credit markets in US Treasuries despite the poor long-term outlook for these assets.

Higher bond yields and economic recession are both politically unpalatable so further central bank purchases of domestic bond markets are expected. Economic historian Russell Napier expects pension funds will also be pressured into buying more government bonds, and I agree with this thesis. Western governments will take increasingly drastic measures to prevent normalisation of monetary and fiscal policies.

A liquidity event remains a major risk to bitcoin. There is little doubt in my mind that bitcoin will navigate a trad-fi liquidity event resolutely without the need for interventions because we have evidence of this in 2019 and 2020. But a liquidity event, if it transpires, will pose clear risks to the price of all financial assets, including bitcoin, as investors rush for liquidity despite very strong bitcoin fundamentals.

I have argued in recent months that bitcoin will decouple from trad-fi at some point in the coming quarters and that the strong correlation between bitcoin and equity markets is not a long-term concern of mine. I stand by this view. However, I think that the correlation will remain intact over the coming months. Why?

Sharp liquidity events create fear, that impact almost every financial market participant, no matter the prevailing correlation between asset classes.

The S&P500: BTC correlation is still strong today and it is unwise to ignore the prevailing facts.

The S&P500:BTC correlation tends to be stronger when equity markets are falling and there remains a bias towards equity weakness over the next year after the sharp increase in bond yields.

algorithmic stablecoin BIDDING BTC HIGHER SHORT-TERM

Let me try and keep this complex matter short... Algorithmic stablecoins are category of stablecoins I speak about infrequently because they are more complicated and less widely used. Unlike fully-backed stablecoins, where US T-bills are kept in reserve as the collateral backed the stablecoin, algorithmic stablecoins are unbacked.

Rather they rely on game theory - arbitragers have incentive to maintain the peg. The incentives can work in slightly different ways so let us talk specifically about Terra Luna the stablecoin that is topical today. Luna has a coin and, no matter the price of Luna, investors can always swap one USDT for $1 worth of Luna. If the price of USDT falls to $0.95, arbitragers can buy a USDT for $0.95, exchange it for $1 worth of Luna, and then sell than Luna for $1, thus profiting by $0.05.

This sounds great in theory, but there are potential issues and some of these stablecoins have crashed in the past. Essentially, the system is reliant on Luna maintaining its value and being able to keep the peg. If Luna loses value for an extended period of time and investors question the viability of the whole project, a self-fulfilling prophecy emerges where USDT will very likely trade at a discount and arbitragers will consistently deplete Luna of its reserves until the whole project fails.

In order to back-stop Luna against this threat Do Kwon, the founder of Luna has decided to use its reserves to buy $3bn worth of bitcoin. Whether this works or not is a different question altogether but it is pretty interesting to think about a stablecoin that is now backed by bitcoin. Important to note, the stablecoin is not fully backed by bitcoin and its success or failure says little about bitcoin itself.

The decision is, however, a major vote of confidence for bitcoin as the reserve asset of crypto. It also is a serious consolidation of the crypto industry, which is a normal during weaker market conditions because effectively Luna is selling its own coin in order to purchase bitcoin.

Short-term rally in the context of continued macro pressures

Returning to current market conditions after that lengthy segue, Luna is sweeping massive amounts of BTC off exchanges which has boosted the price of bitcoin. Another way to view this theme is in our short-term liquidity indicator, which has tightened dramatically in recent weeks. Luna is approximately 1/3rd of the way through the purchases and it is possible that they continue to push bitcoin higher. Given the extent of cash on the side-lines and the FOMO crypto investors can experience after a period of macro-induced fear, we could easily pop into the mid to high $50k's.

But despite the strong underlying bid and short-term liquidity squeeze, broad-based demand remains weak and it is questionable that bitcoin will return while trad-fi macro conditions are as weak as they are. Plus, there remains the threat of a full-scale liquidity event in the coming months. The Fed is tightening into what will very likely be an economic recession. Something will likely break in trad-fi markets in the coming quarters, pressuring the Fed into another ludicrous loosening cycle that will dwarf all loosening cycles before it.

ETH Merge: Utopia at first, but risky business ahead

ETH experienced a strong rally in March. The narrative driving the move is the expected shift from Proof of Work to Proof of Stake this year. Arthur Hayes outlines this argument particularly well in a recent article. In my opinion:

The shift from POW to POS promises a lot. If successful, the promises justify ETH strength. Here are a few of the promises

Lower carbon footprint

Greater transaction throughput

Lower transaction fees

A yield bearing asset, comparable with a bond

Shifting from POW to POS is a risky business given the size of ETH

Ethereum has been plannning on transitioning from POW to POS for years so the proof is the pudding

The ETH rally would have been unlikely without the cover provided by bitcoin strength in the previous two months

In summary, there are reasons for be marginally more constructive on ETH at this time, but caution is advised given the stage of the cycle and the expected impact on high-beta assets.

Crypto specific news (Luna BTC purchases and ETH merge) drove strong BTC and ETH performance in March, but the sustainability of the rally remains in question over the coming quarters because of weak overall demand and tough macro conditions. Behind the scenes, bitcoin’s value proposition continues to grow. Each month there are signs that the global monetary system is shifting and evidence is stacking up that bitcoin has a role to play in that transition. I will be looking to make the most of the short-term rally, but I remain cautious for the coming months because a potential liquidity event remains a real risk. Nevertheless, I will remain biased towards the long-side long-term because larger nation-state purchases are not far away.