Market Top? unlikely While BTC Considered Reserve Asset

There has been speculation in the crypto community that the top might be in for this cycle and that prices may decline for an extended period from here. While there are arguments supporting this view, I am unconvinced. Long-term holders still dominate supply suggesting a solid foundation for a continued bull market, sentiment remains contained by many metrics and macro conditions are turning favourably in the face of US rate cuts and USD weakening risks. Besides, valuations have not re-rated at all given ETF success and consideration that bitcoin could be a reserve asset for the world’s largest economy! Trump isn’t everyone’s cup of tea but he’s a future US President and he is considering bitcoin as a future reserve asset - that is monumental!

Early Bull Market is in the Past, but Late Stage is Still to Come

Before we detail all the reasons why this cycle is set to continue, lets touch on the reasons for the market-top speculation. Long-term holders have been selling down their exposure, which has dampened upside price volatility since bitcoin hit new all-time highs.

LTH net profits have also been strong relative to short-term holders (STH).

Despite this selling, long-term holders still control a significant portion of the supply. It is challenging to see an end to the cycle while holdings from these important participants remain as elevated as they are.

Limited Exuberance Thus Far

Usually for a market top to develop, a period of exuberance would be required with plenty of new retail activity. We don’t see anything of the kind according to our metrics.

Google Trends data shows limited interest compared to previous cycles.

No crypto apps are currently in the top app store Finance rankings, a contrast to previous peaks where apps like Crypto.com and Coinbase were highly ranked in December 2017 and Nov 2021.

Coinbase in Dec 2017

Coinbase & Crypto.Com in Nov 2021

No crypto appearances in March or July 2024

While meme coins had their moment, there has been no sign of a broad-based altcoin season yet, as indicated by bitcoin dominance rising steadily through this cycle

Market Structure Changes to Consider

It remains on our mind that the bitcoin ETF’s could change the bitcoin market structure. Evidence for this risk is evident when one considers bitcoin just experienced its longest period without a drawdown of 25% or more. ETF participants contributed towards this outcome, buying up the last price dip below $60K, limiting what would usually trigger a more significant price drop.

The subsequent subsequent decline below $50K (finally triggering a >25% correction) confirms out suggesting that volatility will still remain. It is worthwhile noting that volatility on bitcoin and ethereum have gradually declined over time. ETF should further contribute to this trend, but aren’t necessarily a sea change. Bitcoin is in the process of monetisation and financialisation, which includes widespread adoption and the creation of numerous financial products on top of the asset. All of which will contribute towards lower volatility over time, but none of which should fundamentally change the character of the asset overnight.

Macro Tailwind Strengthens

A key component to our constructive thesis heading into 2025 is the continued improvement in macro conditions. Our macro indicator has risen to its most constructive levels since June 2021.

The key factor driving the recent improvement is the steepening US yield curve. Rising yields in the face of sticky inflation was a factor pressure risk appetite last week but short dated yields are not as sensitive because the Fed is still biased towards cuts over the coming quarters.

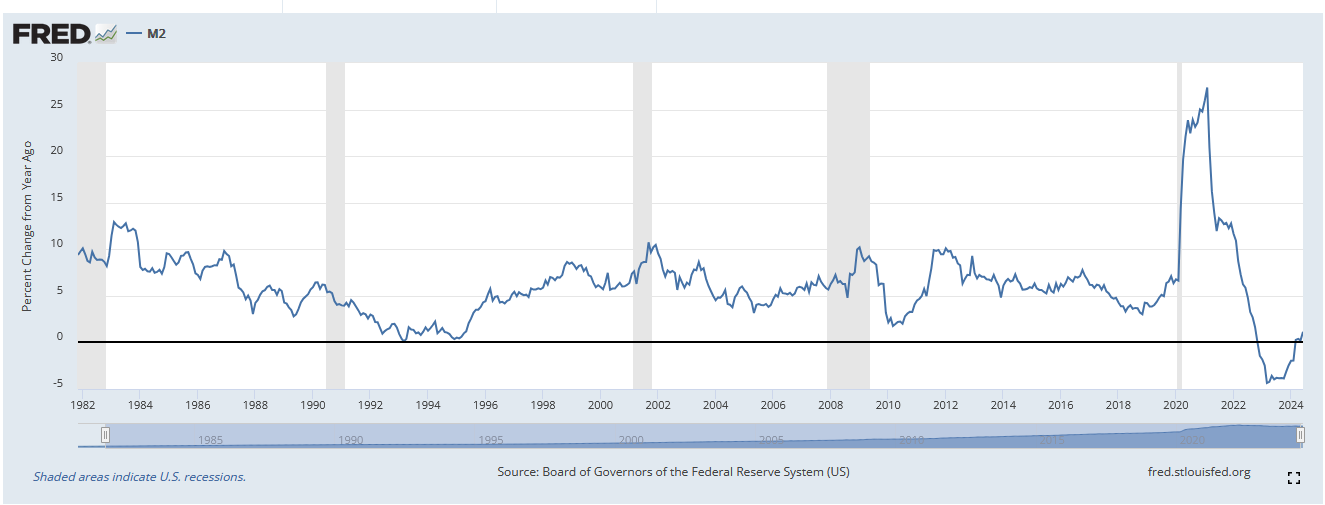

Real rates could drop and further support macro conditions. Moreover, money supply growth has turned positively with significant room to run.

The Bank of Japan’s decision to take a more hawkish stance in the face of higher inflation is also significant to the macro picture. In the short term, the JPY strength caused an unwind of the JPY carry trade, causing the recent market weakness in tech & crypto. But longer term, the JPY strength supports further USD weakness, which is a key factor that could support risk appetite in 2025.

Source: Trading View

Valuation Threshold Hasn’t Shifted

During this market cycle, Bitcoin has grown to a $1.3tn market cap and total crypto to $2.3tn. These numbers are tiny when one considers that gold’s market cap is in the $10-12tn range. These numbers are not commensurate with developments that have taken place during this cycle.

The bitcoin ETFs have been one of the, if not the, most successful ETF launch in history. While the conversation is still in its infancy, a US President could advocate for bitcoin as a reserve asset in 4 months time. Talking about a bitcoin market cap of comparable with gold is not ridiculous given this conversation. I am not saying bitcoin will reach this market cap during this cycle, I am just arguing that it could rise significantly higher.

Monumental Monetary Regime Change Signpost

For years we have said, "we are in the midst of the monetary regime change”. In July 2024, the US considered appointing Bitcoin as a reserve asset, marking a monumental event and a clear signpost along the path.

Trump is a Side Show

I acknowledge that Donald Trump is a polarizing figure and there are tones of uncertainties

He might not win the elections (Polls have narrowed remarkably vs Kamala Harris in recent weeks)

He might not adhere to his promises if he does win (He's shooting from the hip populist)

He will face political obstacles in implementing policy recommendations

I don't want Donald Trump as the voice of bitcoin - he does not properly understand the technology

However - we are were we are. Trump is a front-runner and with each passing month he has become increasing favourable towards crypto

Campaign Donations: This trend may simply reflect the growing economic influence of the crypto industry. Not ideal, but that would show the increasing economic might of the industry.

Knowledgeable Advisors: Trump might not understand crypto but his running mate (JD Vance) and Chief of Staff Vivek Ramaswamy) are well-versed

Initiating the Conversation: Even if the discussion fades, the world's largest economy has considered Bitcoin as a reserve asset, enhancing its legitimacy

Policy Recommendations and Likelihood

1) End anti-Bitcoin policies (Fire Gary Gensler & End Operation Chokepoint 2.0)

Both within presidential power and impactful, as both Gensler and FDIC's Martin Gruenberg have been major obstacles to crypto.

2) Embrace stablecoins, Block CBDCs and block future attempts

The President would require Congressional support for stablecoin regulation. Given the positive impact that fully reserve backed stablecoins have on demand for Treasuries, and the need to contain yields in the face of bloated government debt, it is a no brainer for US politicians to support stablecoin regulation. Stablecoin regulation would significant encourage the adoption of these powerful monetary instruments and make onboarding into decentralised crypto assets, like BTC and ETH, much easier. I.E. This is achievable and impactful.

3) Create a “Strategic National Bitcoin Stockpile” i.e. direct the US Treasury to build a reserve of bitcoin with the DOJ’s current holdings as its “core”

Given the recent bipartisan support for crypto regulation in Congress it is out of the realms of possibility that Congress could be convinced to stop selling the bitcoin's confiscated by the Department of Justice

The US government currently holds about 213,546 Bitcoins (approximately 1% of the max supply), mainly from Silk Road and Bitfinex hack confiscations.

Source: Binance

I am less clear on the path required for the Treasury to bitcoin in a similar fashion to gold, holding it in strategic reserve. I assume this might be a bigger leap for conservative Congressmen & woman. But, as I have said before, putting the conversation on the table is significant, allowing advocates to chip away at the obstacles towards its eventual completion, even if that is years away.

Currently, El Salvador is the only country in the world that is known to actively purchase bitcoin. This was a significant development but El Salvador's GDP is approximately $30bn (equivalent to Honduras, Paraguay, Armenia and Uganda), which is 0.1% of US GDP ($27tn). I.E. El Salvador is shaking things up but it is a drop in the ocean and easy for critics to write off as insignificant! The US Treasury is a whole different ball game.

The current state of the crypto market, particularly for Bitcoin, suggests a continued bullish outlook despite recent speculations of a market top. Long-term holders still dominate the supply, and market sentiment remains subdued, with macroeconomic conditions turning favorable, particularly with the potential for US rate cuts and a weakening USD. The consideration of Bitcoin as a reserve asset by a future US president underscores the growing legitimacy and adoption of Bitcoin, taking it to a level of prominence only the staunchest of advocates could have considered a few years ago.