Market Review (May 2022): Fed preparing for capitulation

The Terra Luna UST collapse dominated crypto markets in May 2022, which is the subject of “Scepticism pays during “Crypto’s Lehman’s”. Despite the focus on Luna, the unraveling of this experimental crypto must be viewed in the context of the Fed liquidity winter. Luna’s growth and eventual unwind would have been highly unlikely without the liquidity injections of 2020/2021 and the subsequent tightening of 2022. Now that the winter is biting in earnest, the first signs of Fed policy reversal are underway. TLDR: More pain is expected in crypto over the coming months as Luna unwind takes demand into bear market territory but we are approaching the bottom of the macro cycle and the Fed is preparing for loosening in 2023.

Highlights

Liquidity tide goes out, exposing assets further out on the risk curve.

Scepticism, caution and asset allocation pay dividends.

Macro conditions start to improve but too early to call a macro bottom.

Fed laying the groundwork for its capitulation as recession fears increase.

Luna unwind has hit bitcoin demand, providing caution for the next quarter.

Bitcoin dominance will confirm creative destruction.

trad-fi retraces pandemic rally

Let us take a moment to highlight the pain being felt in trad-fi in 2022. Highs to lows, Netflix has fallen 77%,

while Facebook/Meta, Tesla and Amazon have fallen 56%, 50% and 46% respectively, erasing the pandemic gains.

If you go further out on the risk spectrum, Zoom (the pandemic darling) has fallen 87%.

Fed liquidity winter bites

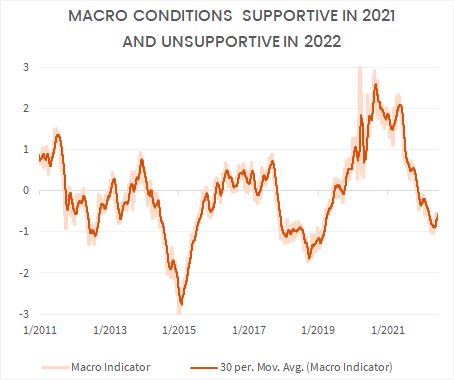

The Fed may have only increased short-term interest rates to 80bps but financial conditions tightened sharply over the last 9 months as the market priced the tightening on behalf of the Fed. The USD strengthened, the yield curve inverted and real interest rates rose sharply. Our macro indicator highlights the extent of the tightening.

While liquidity is flush, all sorts of investments seem like a good idea. At the extreme, with zero interest rates, what investment is not worth a punt? When that liquidity is withdrawn, it is like the tide being withdrawn in the ocean, exposing the shoreline. We get to see who has their pants on. There are lots of projects that have been exposed, in the traditional markets and crypto.

Source: Wikipedia Commons

Conservatism and asset allocation pays in liquidity winter

Bitcoin and Ethereum have fallen 60% and 65% respectively under these conditions, comparable to the tech names mentioned above. However tech is the underperforming sector within equity markets and bitcoin is the outperforming asset within crypto. Much of the rest of crypto has crumbled. There were three darlings of the 2021 crypto cycle, SOL and AVAX, which have both fallen 85%, and LUNA which has effectively gone to zero.

In May specifically, BTC fell 22.6%, ETH fell 35.5%, AVAX fell 53% and SOL fell 46%. The degree to which the price of non-bitcoin assets have declined in the last month highlights the way in which risk appetite tightened across the curve. Investors are now starting to question whether these projects are truly decentralised and whether the use-cases are viable, among other existential questions. Many crypto projects will not make it through the winter, which has long been a concern of ours.

Macro improving as Fed capitulation approaches

Now that the full might of the tighter liquidity conditions are being felt, we are seeing the first signs of reversal. Longer dated US yields are falling, inflation is expected to moderate marginally and our macro indicator has ticked up. It is too early to conclusively determine that we have reached a macro bottom for this cycle, but this is an important signpost to take into account.

At the same time, FOMC members have started to speak about the prospect for loosening in 2023 and the Treasury has its eye on the bond market:

Can Be Lowering Rates In 2023, 2024 If Get Inflation Under Control - Bullard

Sensitive to causing disruption in financial markets - Bullard

Concerned about Treasury market functioning - Yellen

James Bullard is the FOMC member that laid the groundwork for tightening in 2021 so I expect that he is now preparing the market for the eventual reversal in policy. This may seem like a crazy idea when inflation is >6% above the Fed’s target, but we know that the Fed will prioritise short-term stability over inflation.

The longer term context always helps to reiterate the Fed’s priorities - the last time US debt levels were this high, real interest rates averaged -2.6% for 20 years. The Fed must monetise US national debt through inflation. In the short-term, economic and financial stability are an excuse to turn policy around before inflation falls back into the Fed’s target.

The financial market unwind has been pretty orderly thus far, but just like the tighter liquidity conditions exposed Terra Luna in crypto markets, there are ghosts within the closest in traditional financial markets that will likely be exposed over the coming months. On the economic front, recession signals are already flashing red. The University of Michigan consumer sentiment index is at levels comparable with past recessions.

The ISM manufacturing PMI is turning lower and the Philly Fed index suggests there is more pain to come.

Source: Nordea

noticeable decline in broader bitcoin demand

While the longer term picture continues to improve and the Fed is edging closer to a change in policy, short-term conditions remain challenging.

I expected to see a crypto rally post the disorderly Luna unwind and the indiscriminate selling of crypto assets. The rally has eventually taken place in late May and early June but it has been tepid thus far. Global equity markets rallied into the end of the month to close flat for May. Crypto eventually followed but it lagged in its response to trad-fi, which is not the type of decoupling crypto wants to see.

Of additional concern is the sharp reduction in bitcoin demand seen post the Luna unwind. Our demand indicator is beginning to test the 2018 bear market lows. This does not bode well for returns over the next quarter. I expect this rally back into the $30k’s to be short lived.

The creative destructive of the Luna unwind puts bitcoin and crypto on a stronger footing longer term, but the impact on demand has been noticeable. The Fed is edging closer towards capitulation and macro conditions may be starting to improve but it is too early to conclude that the macro bottom has formed. I expect bitcoin dominance to rise further over the coming months as investors continue to question the viability of more fringe crypto use-cases. Rising dominance will confirm that the creative destructive has played out and by that time I would expect the macro bottom to clearly have formed.