Crypto is the last bastion of free markets, where creative destruction is still allowed

This article was written for Hedge News Africa

In my February 2022 HedgeNews Africa article “The challenge and opportunity of a lifetime” I laid out the investment case for bitcoin based on ESG and reserve asset criteria. The recent collapse of the crypto markets provides an opportune moment to revisit and reflect. Clearly there are lessons to learn and soul searching required. But contrary to the commentary from many pundits, the cleanse under way in crypto 2022 is one of its biggest strengths. It is exactly at the time when detractors are trammeling on the grave that investors should take interest.

Key insights

Liquidity has been withdrawn and cracks are showing across financial markets

Trad-fi (traditional finance) has been obliterated, particularly tech, and crypto has not been spared

Numerous terrible projects in crypto have crashed or at least underperformed bitcoin

Crypto cleanse is healthy: bad investments are disciplined and capital is reallocated

Trad-fi has not solved any problems and the Fed Funds Rate has only reached 2.5% (after the July hike)

Recession is incoming and real rates are already negative

Monetary experimentation will intensify and monetary alternatives are required

Crypto’s response to volatility displays its antifragility.

“When the tide goes out, we see who has been swimming without their pants” Never was Warren Buffet’s adage as pertinent as in 2022. The central bank liquidity tide has pulled back from the shore and financial markets have been revealing vulnerabilities ever since.

Highs to lows, Amazon has fallen 46%, Tesla 50%, Netflix 77% and Facebook 60%. Crypto has not been spared in this rout, with bitcoin falling 75% and ETH (Ether) 82%. In all honesty, the extent and speed of the decline has surprised me, but the volatility and weakness are unsurprising. In our February 2022 HedgeNews Africa note we said:

Over the short-term, the outlook is heavily impacted by the Fed’s monetary policy trajectory. The Fed is planning to hike interest rates and remove quantitative easing in 2022. It is worth bearing in mind that if the Fed truly normalised monetary policy... the argument for bitcoin would diminish substantially.

Some market participants have questioned the whole crypto project in the face of tighter central bank liquidity, and some projects were certainly swimming without their pants. Catching headlines, Terra Luna fell pretty much to zero in 2022, wiping out US$40 billion of investor assets in one of the most spectacular failures in crypto history. Once again, the extent and the speed of the unravelling surprised me, but the volatility and weakness of non-bitcoin projects is unsurprising. We said in February 2022:

There are fascinating innovations across the crypto markets as developers apply the concept of digital scarcity to broader financial applications, like art, entertainment and gaming. Many investors will extract incredible returns from these protocols, but newcomers must be aware of the riskier nature of these investments. The use-cases are usually more tenuous than bitcoin’s and hence expose investors to greater risk... bitcoin will likely outperform higher risk assets this year.

How have these spectacular failures happened?

1) Crypto is a free market of innovation During times when liquidity and funding flush, all sorts of bad ideas appear attractive. This principle holds in both trad-fi and crypto. In crypto, there is just less regulatory oversight and the nascent nature of the technology offers developers numerous opportunities for experimentation. Experimentation will result in success stories, and failure too. Terra Luna is one of those failures – there have been and there will be many more. These failures are a reminder to remain sceptical and have strong foundational principles, rather than merely jumping onto the hype train during exuberant times.

2) Centralisation is contrary to crypto principles and masks trad-fi risks While crypto is built on the principle of decentralisation, true decentralisation is difficult and costly. Numerous crypto projects and protocols are far less decentralised than many guessed. Centralisation introduces all the human errors of rehypothecation, greed and even outright fraud – crypto had all three in the past year. This does not imply that centralisation is bad in all cases and that everything must be decentralised. But as with any project that introduces risk, investors must conduct proper due diligence and credit risk screening.

If investors are unwilling or unable to put in the due diligence work, then it is much simpler and safer to stick with bitcoin. As we said in February:

It is most prudent for newcomers to focus on the value proposition offered by bitcoin’s scarcity, security and decentralisation.

Crypto is the last standing free-market and the cleanse is healthy

Despite the trauma experienced by crypto markets in 2022, the cleansing is one of the most positive things about crypto. Bad ideas are uncovered, bad businesses default, bad investments are liquidated and capital is reallocated towards successful endeavours, which enhances productivity. This is the essence of the freemarket mechanism – a mechanism that used to work in traditional financial markets!

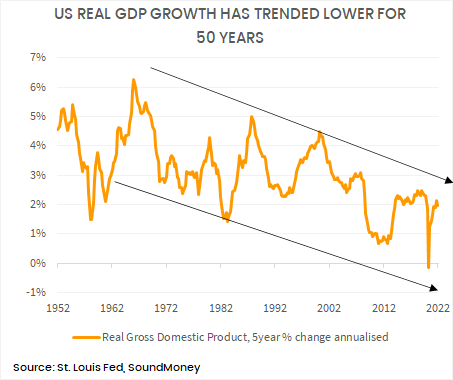

Excessive central bank and fiscal support implies that trad-fi never experiences the full might of the pain. Bad businesses are inevitably bailed out because they are “too big to fail” or politicians cannot bear the transitory job losses. This is a key reason western economies have become saturated with debt, inefficient, productivity rates have declined and economic growth rates have trended lower in the past 50 years.

The Fed is not far again from further financial repression

While the Federal Reserve is currently tightening policy, the market has already started to price more than 50bps worth of cuts for 2023. Why? Debt-saturated economies cannot handle a tightening of credit. The Morgan Stanley recession probability index shows that a recession has now become a high probability event, pushing the Fed closer to capitulation. The Atlanta Fed is now forecasting a contraction in US real GDP in Q2 2022.

Bear in mind that the Federal Reserve has only increased the Fed Funds rate to 2.5% in the past six months. The inability of the economy to handle such miniscule interest-rate increases is not a sign of economic strength. Real interest rates have remained deeply negative throughout the tightening cycle. When we pull back the lens, the 2022 tightening cycle will look tiny in comparison to the broader trend of financial repression. In fact, it already looks that way!

Monetary authorities are compelled to repress all holders of government-issued currencies in order to monetise debt levels, which sit at historic highs. And investors are compelled to find the best assets which can protect them against this financial repression.

The July FOMC press conference already suggests that the Fed is reaching its pain threshold, so it is very unlikly traditional markets would experience a crypto-style cleanse. At Sound Money we think decentralised digital sound money is compelling. Bitcoin and the rest of the crypto ecosystem has the monetary qualities on which a future monetary regime can be built, free from financial repression. Volatile, for sure, but bitcoin has experienced numerous drops greater than 70% and has still never posted an annualised four-year percentage change less than 25%. There is plenty of risk and failure, so yes a prudent strategy is required when approaching this market. But this is the crypto system, where failure is disciplined and capital is reallocated, which is a foundational principle of market economics. We are proud to invest in free-market crypto. We are working on solving the world’s biggest problems and are optimistic about our ability to escape the next phase of financial repression enacted by the Fed and its central banking peers.