Central banks are preparing for a monetary regime change, are you?

At Sound Money Capital we theorise that the world is in the process of a monetary regime change. We expect that bitcoin and the crypto ecosystem could have a role to play in a future monetary system, which creates a compelling argument to allocate to the asset class. Central banks cannot admit it, because they are the custodians of the existing regime, but their actions reveal agreement with our thesis after they amassed record gold purchases in 2022. TLDR: Central banks are preparing for a monetary regime change, are you?

Conclusions:

Record central bank gold purchases directly contradicts their hyper monetary inflationary policies

There is an essential truth contained in this simple but egregious contradiction between central bank policies

Monetary regime change risks are a reality

Monetary alternatives and store of value assets are misunderstood

Bitcoin is a superior technology to gold

Bitcoin-gold correlation has strengthened, while bitcoin-equity correlation has weakened, confirming a cyclical shift towards bull-market

ETH is poised for outperformance vs. BTC in these conditions

The market chose gold as money

Similar to bitcoin, gold is a scarce asset with no yield. It does not produce anything, making it a non-traditional investment. Its supply is not easy to tamper with, so rather than generating wealth, gold is an extraordinarily good long-term store of wealth/value.

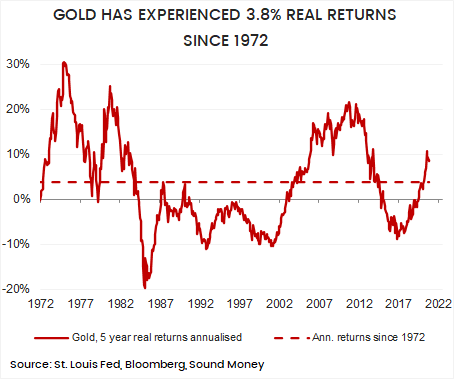

Gold has experienced real returns of 3.8% since 1972

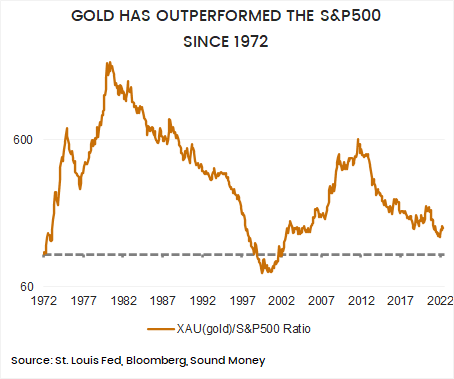

Gold has outperformed the S&P500 since 1972

Many assets have been chosen by the market as money throughout history but societies around the globe gravitated towards gold because it was scarce, and difficult to manipulate, but still had enough liquidity to facilitate transactions.

Societies only moved away from gold during the age of fiat money when governments imposed monopolies on money. Initially, fiat monies innovated on top of gold by offering paper receipts linked to gold. Paper was easier to transport and trade than physical gold. Eventually governments broke the linkage to gold because of the irresistible urge to issue more paper receipts than physical gold in vaults. Henceforth fiat money no longer stored wealth/value.

Central bank contradiction reveals critical knowledge

Without the anchor provided by gold, monetary policy has become increasingly unorthodox, leading to record-high debt levels and record low-interest rates.

In stark contrast, central banks hold most of the world's gold and 2022 saw the largest central bank gold purchases on record.

German philosopher Georg Hegel said "contradiction is not a sign of falsity, nor the lack of contradiction a sign of truth" suggesting that contradictions can be valuable and essential in the pursuit of truth and knowledge.

There is an essential truth contained in this simple but egregious contradiction between central bank policies.

Central banks are preparing for crises

We expect that central banks are preparing for an uncertain monetary future. Their position as high priests of the existing system merely prevents them from admitting the motivation for their actions. Here are the two key reasons why monetary change looks increasingly obvious:

No monetary regime lasts particularly long. We have had at least 3 monetary regimes in the past 100 years.

The current monetary system is creaking with record high debt levels and record low interest rates.

Who knows what the future holds, but it is far less certain that the current monetary regime will be intact in 20 years’ time than it was 20 years ago. Central banks are returning towards an asset with historical monetary credibility as a store of value and a pillar of stability during times of crisis. Gold is also appealing to central banks because they control at least 17% of the market.

Central banks probably hope that they will control the transition to a future monetary regime if they continue to control a lion’s share of the monetary asset that societies have gravitated towards throughout history. Unless of course, the market gravitates towards a superior monetary technology.

8 Reasons why bitcoin is a superior technology to gold

Bitcoin will become scarcer than gold because its supply is capped as supply growth is diminishing exponentially

Existing bitcoin supply is not cornered by centralized entities like central banks, which control the gold market

Storage and transfer are cheaper, easier and safer than gold (imagine transporting $1bn worth of physical gold from China to the US vs. sending the capital in one on-chain bitcoin transaction)

A bitcoin can be divided into 100 million pieces (satoshi's) so it is far more flexible and accessible to lower-income groups than gold bars and coins

Bitcoin is the first digitally scarce asset with one of the strongest adoption curves of any technology in history

Internet native money on top of which numerous applications can be programmatically built. The cryptocurrency ecosystem is experimenting with numerous financial use-cases for digital scarcity

Bitcoin mining makes stranded energy valuable, providing a conservation incentive

Built-in payments infrastructure, whereas gold payments must be facilitated through centralised entities (card companies and gold custodians) who must settle underlying in background (customer must pay for service and credit lines are required to facilitate transfers)

Investment Managers struggle to model regime change

The relative arguments in favour of bitcoin and gold are somewhat tangential to the broader conclusion here. Central bank actions reveal an increasing concern with the stability of the existing monetary system. The question is, do you hold any assets which serve as alternative monies to fiat USD, GBP and ZAR?

In my extensive institutional money management experience, I noticed that traditional investment managers do not like store-of-value assets like gold because they do not fit into traditional valuation methodologies like dividend discount and discounted cash models. Understanding of and allocation to store-of-value technologies like gold and bitcoin is insignificant as a result.

CORRELATIONS PROVIDE CONFIRMATION OF CYCLICAL SHIFT

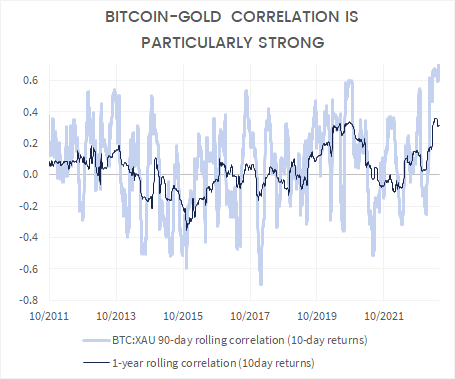

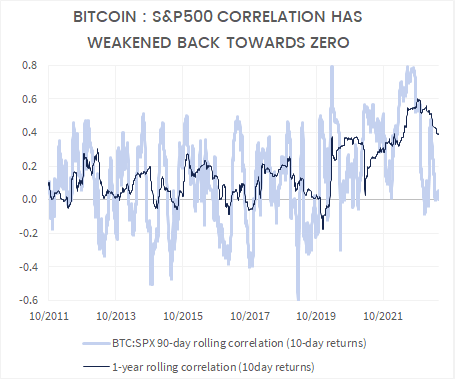

While we are on the topic of gold, it is interesting that the correlation between bitcoin and gold has risen to some of its highest levels on record. This comes on the back of the breakdown in the much talked about correlation between bitcoin and equity markets.

Similar to the bitcoin-equity correlation, I expect the correlation between bitcoin and gold will wax and wane through the various macroeconomic cycles, but it does offer some insights about the cyclical conditions today. Bitcoin is not acting as high beta equity; bitcoin is acting as a store of value.

Also interesting that the correlation tends to be stronger during bitcoin bull markets, creating further confirmation that we are in the midst of a crypto bull market. We expect we are in an accumulation phase where it pays to be positioned long because a trigger for more aggressive gains will likely but ‘unexpectedly’ emerge over the coming quarters. Ethereum is poised for greater outperformance potential vs. bitcoin in these conditions, with the ETHBTC potentially testing the 0.09 region.

Some may not find this argument for bitcoin allocation compelling because they do not like gold. Others will not find the argument compelling because they are happy to trust in the incumbents. After all, speculators have been warning about the Japanese debt bubble for decades and policymakers appear to have managed that situation appropriately. I appreciate this logic but as Peter Drucker says, "The greatest danger in times of turbulence is not the turbulence itself, but to act with yesterday's logic." From my vantage point, it is as clear as day that the monetary regime is changing. Central banks stacking up on that barbarous relic, gold, is merely another signpost along the path.

Until next time