CBDCs: Incumbents market failing product to maintain control

As US authorities clamp down on crypto in 2023, we have observed a remarked uptick in articles, speeches, and searches for "central bank digital currencies". As I mentioned last month, I do not think these simultaneous trends are coincidental. "The incumbents are marketing their failing product and attacking the competitor." In this article we detail the arguments for and against CBDC's, providing evidence for our sceptical conclusion. TLDR: Eventually the torrential tides of technology, freedom and crypto will prevail but, for now, authorities are trying to maintain control through marketing structurally unsound fiat money as a technological upgrade.

Source: Google Trends

Conclusions

Like many government programs, the proposed benefits of CBDCs disguise the reality

Centralisation and decentralisation have clear trade-offs

Central fiat and CBDCs favour control and efficiency over freedom, privacy, fairness and systemic robustness

Bitcoin is not particularly efficient but it is impossible to control, inclusive, respectful of privacy, fair and robust

Governments will utilise CBDCs as another tool to try and maintain control over impending fiscal crises

CBDCs bypass commercial banks, providing greater control to regulators

The main difference between traditional money and CBDCs is that traditional money can exist in physical form, while CBDCs exist only in digital form. Current money is also usually issued by commercial banks, while CBDCs are issued directly by the central bank, bypassing commercial banks. Proponents of CBDCs argue that they have the potential to offer several benefits:

Efficiency: CBDCs could reduce transaction costs and increase the efficiency of payment systems. Unlike traditional payment systems, CBDCs could allow payments to be transferred instantaneously.

Security: CBDCs could provide enhanced security features that traditional forms of currency lack. For example, CBDCs can use cryptography to secure transactions and prevent counterfeiting.

Financial Inclusion: CBDCs could help promote financial inclusion by providing access to financial services to unbanked or underbanked populations. Everyone with a government ID would likely gain access to an account.

Monetary Policy: CBDCs could provide central banks with greater control over monetary policy because they would bypass banks, distributing credit directly.

Fiscal Policy: Financial officials could readily make payments to targeted groups, communities or families.

Like many government programs, these proposed benefits disguise a more complicated reality below the surface.

The trade-offs of Centralisation and Decentralisation

Centralised systems can often be more efficient than decentralised systems. However, there are trade-offs. For example, a highly centralised system like the military is usually efficient at executing certain tasks.

Centralised control can lead to military precision

But a centralised militaristic structure is clearly not a good structure for society at large and the efficiency thereof is highly dependent on the people in charge. Very large centralised systems can become unwieldy and potentially inefficient because of the bureaucracy involved. For example, put bad leaders in charge of the military and you have a dangerous organisation.

Idi Amin ruled as Uganda’s military dictator in the 1970s and is considered one of the most brutal despots in history

Efficiency at what risk? MORE power to politicians?!?

So, yes CBDCs would most likely be more efficient than the current monetary and financial system and they could be more efficient than crypto too, but what are the trade-offs? Decisions would sit with one central entity, which introduces significant concentration risk.

On the technical front, how can we be confident that this technology would work properly? Governments are not renowned as the most tech-savvy organisations on earth… What would happen if errors occurred? And who would adjudicate those errors?

Here begins the start of endless questions about the efficacy of CBDCs.

Technical shortcomings and the implications for security are a concern that could be overcome but centralised systems are entirely dependent on the quality of the centralised entity, raising far bigger risks.

CBDCs could be inclusive, but what if the politicians in power decide that they do not like your political stance and decide to freeze your CBDC wallet? Politicians in many countries around the globe showed autocratic tendencies during COVID. For example, the Canadian government froze the bank accounts of anyone associated with the trucker protests. Perhaps you are not perturbed because you do not like the political disposition of truckers, but then just imagine your most hated right-wing politician was in power. Would you want them to wield this power?

CBDCs would almost certainly entail a massive reduction in personal privacy. Similar to the trucker argument above, there will be many that may argue that they have nothing to hide. Governments will press hard on this narrative, arguing that privacy advocates are criminals trying to evade the law. However, privacy is a basic human right. There are almost certainly pieces of information that you would prefer to remain private. Would you want a camera recording every movement in your bedroom? Of course not. Similarly, every personal transaction does not need to be monitored by governments.

CBDCs could provide central banks with more tools to execute monetary policy, but is this desirable? Central banks have overseen the most egregious increase in global debt levels and interest rates have fallen to the lowest levels in history with very little consideration of the consequences. What good will we achieve by giving them greater power?

There are massive trade-offs with centralised fiat money, favouring control and efficiency over freedom, privacy and systemic robustness . By contrast, bitcoin is not particularly efficient and it is impossible to control. But there is a reason bitcoin why and the rest of the crypto ecosystem decentralises monetary control away from any single entity. Bitcoin creates a monetary system where the monetary policy is transparent for all users. There is plenty of privacy for day-to-day transactions but large transfers can easily be tracked and traced by industry participants to ensure significant crime is curtailed. Bitcoin is incredibly inclusive because anyone can utilise the network. This is why bitcoin is such a powerful tool for freedom in Venezuela, Turkey, Nigeria, Afghanistan, etc. Bitcoin is also far more secure than any financial competitor so it scores very well relative to the 'benefits' suggested by CBDC proponents.

It is all about control

There is a reason why China was one of the first countries to investigate CBDCs. China is a centralised economic and political system where control is paramount to social stability.

“We don’t know who’s using a $100 bill today and we don’t know who’s using a 1,000 peso bill today. The key difference with the CBDC is the central bank will have absolute control on the rules and regulations that will determine the use of that expression of central bank liability, and also we will have the technology to enforce that.” Augustin Carstens (Bank International Settlements)

Politicians do not like it if they cannot control cash and they do not like it if they cannot control cryptocurrencies so they have come up with a response, CBDCs. If one is aligned with the statist agenda, one could obviously view this type of control positively, but the evidence of recent years shows that governments have abused their control.

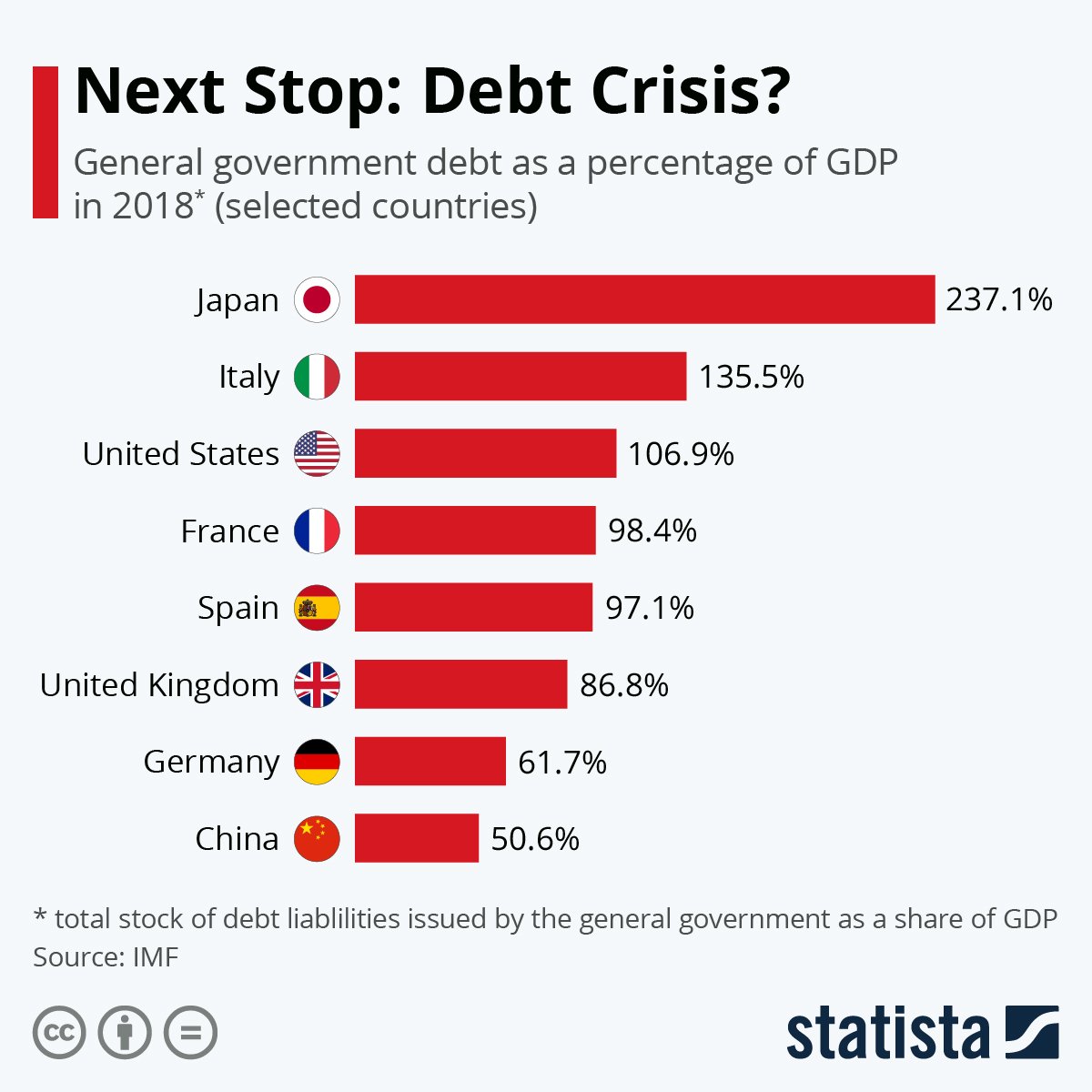

Logic suggests that more control will need to be exerted in the coming years to deal with the massive fiscal challenges facing most governments.

Governments need to pressure certain entities to hold their debt despite the ballooning supply and crashing value of that debt, which explains the push towards increasing the mandated holdings of government debt for asset managers and insurers.

Governments need to pressure people to hold currency despite rising inflation and the declining value of that currency, they need to exert control in order to maintain social order despite the declining efficacy of their social programs and they need to maintain tax compliance despite the declining quality of social services.

The 2023 banking crisis further accentuates the imperative for authorities to shore up their grasp on their increasingly shaky financial system. We wrote about the banking crisis in more detail in our recent Market Review: BTC hits $30K resistance as Banking Crisis deepens.

In our opinion, CBDCs are a tool whereby governments will attempt to maintain some semblance of control over an increasingly chaotic financial situation.

Liberation of money is a principle worth fighting for

The truth of the matter is that money is too important a technology to be in the hands of government. We do not trust government with the provision of many other essential products, like food production, why trust them with money? CBDCs could be faster a cheaper than the current mainstream financial technology but they do not fix the structural issues related to the centralised corruption of money.

CBDCs will likely go ahead over the coming years and there is very little we can do about it. What we can do is read between the lines and take measures to protect ourselves against the impending control. This will hopefully appear increasingly obvious to those with a sceptical predisposition but it may not agree with the philosophical bias of many others.

The world is a very scary and uncertain place at times - that is particularly the case in the 2020s. During times like these, people look towards those in authority for guidance and leadership, even if those leaders do not deserve their trust. These types may blindly accept the somewhat compelling CBDC narrative and ignore the incredulous abuse of their trust.

For those who fall somewhere in the middle between sceptical and trusting, hopefully, this article resonated. It is time to decide for yourself which is the true technological innovation that might be able to solve systemic financial/monetary problems, CBDCs or crypto.