Scarce digital tech (tesla) is not digital sound money (bitcoin)

Tesla has announced that it purchased $1.5bn worth of bitcoin in Q4 2020. Bitcoin adoption by a globally renown company is exciting, and it’ll probably trigger the next phase in this bitcoin bull-market, but I’ve got mixed emotions. Bitcoin could be caught in Tesla’s narrative, which is frustrating because there are two distinct assets. Untangling the differences between these monetary hyperinflation-influenced assets causes me to be less negative on all scarce assets going forward, which is a useful mindset during this increasingly crazy financial market. Brandishing these two assets with the same brush could detract value and cause under-allocation to the most important and scarcest digital asset, bitcoin. [8-minute read]

Monetary inflation creates tall stories

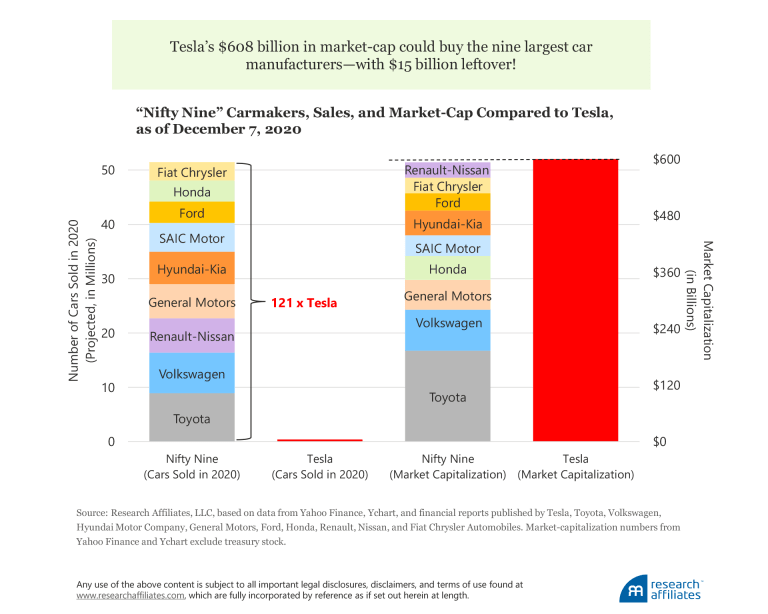

Tesla is a narrative stock. Look at the data… Car sales don’t justify the valuation. Tesla comprises a fraction of global vehicle sales but it’s the biggest car manufacturer by market capitalisation by a mile. Tesla trades at a Price/Earnings ratio of 1000, which has been as high as 5000 in the past. By comparison, Apple trades at 36, Microsoft at 34 and Amazon at 77. I’m not arguing that Tesla could never justify its valuation or that people should sell their Tesla shares, but clearly the monetary distortion of its valuation is massive. The valuation is impossible without record low interest rates, debt levels and QE driving cheap money into unrealised visions of the future.

That’s exactly the dynamic created by low interest rates, debt and QE. Monetary inflation creates the illusion of savings, which emboldens entrepreneurs to invest into long time-horizon assets in the hope that investments will be realised in the future. Since these investors are made on a faulty premise, many of them prove to be mis-allocated capital. Usually we see a correction of interest rates and debt during a business cycle, which reveals savings to be an illusion, forces entrepreneurs to adjust their time-horizons and liquidate mis-allocated capital. However, that type of correction in monetary policy hasn’t been forthcoming for over a decade and authorities are hell-bent on trying to prevent it in the future. So, asset time-horizon lengthens and lengthens, and narratives compound on top of existing narratives.

Is bitcoin a tall story too?

Bitcoin is driven by many of the same dynamics as Tesla.

Bitcoin is a direct response to monetary conditions. If authorities righted the course, normalised monetary policy and implemented fiscal rectitude, then the argument for bitcoin would be challenged. This is a low-probability event, hence my bitcoin conviction.

Bitcoin is useful today but most of its price is based on the expectation of how much more useful it could be in the future. Its also a long time horizon asset, wrapped in a story about the future. Obviously, I have high conviction on this story and each new government stimulus measures enhances the message, but let’s call the spade a spade.

If I apply this logic to bitcoin, I must apply it to Tesla too. Tesla could continue to rally as free money floods into scarce assets… Here are a few learnings from the Tesla bitcoin relationship.

1) Asset Scarcity> Revenues

I’m warier of writing off scarce technology assets during our developing monetary hyperinflation, including Tesla.

I’m reminded of an argument a mentor used to make; equities protected value during Zimbabwe and Venezuela hyper-inflations. Revenues become so scarce when real economic growth is faltering and accounting for them so challenging due to price distortions that investors will pay for alternatives. For example, the promise of future revenues, which is usually based on access to a new technology or market with unrealised revenue. Another example, scarce assets that will protect against monetary debasement and could be sold for revenue in the future. At the extreme, scarce assets are more important than revenue because revenue needs to be exchanged for scarce assets, which involves transaction costs.

I’m no Tesla expert, but (apart from pure speculators) I suspect this is the investment premise. I hear about all sorts of tesla’s scarce technology prospects – or at least innovations from its sister company SpaceX*. Global satellite-based internet via star-link, for example. Mars exploration can be categorised in the same way. If successful, SpaceX will have opened a massive new market for all sorts of opportunities. Mars is clearly more speculative than star-link, but the logic holds. Investors are willing to pay for scarce digital technology assets and ideas which could claim those asset.

*The tenuous formal relationship between SpaceX and Tesla raises a few more questions and hence my on-going scepticism.

2) Growth is the new Venture Capital

To reiterate, the market would never take this approach to asset valuation if monetary policy were normalised. But the 2020s aren’t not normal. Monetary distortions have become so ridiculous than investors aren’t investing into “growth stocks” anymore. They’ve moved earlier into the capital structure. Now they’re paying for super early stage growth. Its like all investors have become venture capital investors as we all speculate on an increasingly uncertain future. Tesla isn’t a growth company; Tesla is a massive seed-stage start-up firm with endless access to financing as long as it captures audience attention. Seen through this lense, overpromise and future narratives are Elon’s best corporate strategy. If he captures attention, the market will continue to give him opportunities.

Everyone knows that if you give a smart founder enough opportunities, he/she will eventually succeed. Usually, there are tones of failures, bankruptcies and frauds along the way, but cheap money has brushes those under the carpet. Cheap funding has given an inventive entrepreneur (Elon) numerous opportunities to execute upon his ideas, without the true discipline of monetary pressure. And a few of the projects will come off at some stage. So maybe the cult investors who follow-Elon, are right? Believe in Elon and trust in his wisdom? Obviously, there are major floors in this argument, but hopefully you see the picture I’m creating. This type of logic could continue for years to come and could drive Tesla higher still.

No, I’m not going long Tesla, but it’s critical to question previous assumptions!

3) Oversimplification will detract value

Despite this learning, Bitcoin and Tesla are two distinctly different assets that are being caught up in the same monetary hyperinflation theme. Bitcoin is a direct response to monetary inflation; tesla merely benefits from it. Bitcoin is a decentralised protocol; tesla is a centralised tech company led by a visionary. Tesla benefits from lax SEC regulations; bitcoin is impervious to regulations. If bitcoin becomes a global monetary standard, this would dramatically shift the cost of capital for Tesla, which isn’t necessarily a good thing for it. By contrast, if Tesla succeeds this would have very few implications for bitcoin.

Tesla’s bitcoin holdings are monumental development but they only account for 0.2% of its market capitalisation. Tesla has had a strong correlation with bitcoin in the past, but these are not the same assets. Investors who make this conclusion expose themselves to risks. For example, tesla detractors who merely ignore bitcoin will lose out of the asymmetric investment opportunity of our generation. Tesla lovers who think they’ll gain bitcoin exposure through tesla, run a similar risk – they’ll be underexposed to bitcoin.

Tesla is a VC call option on exciting tech, bitcoin is a digital store of value. Investors may be buying tesla as a store of value, but it’s not a pure store of value, which obviously poses risks. Don’t assume these assets are the same!

Scarce innovative tech is not digital sound money

Tesla’s bitcoin adoption is exciting, no doubt. It’s probably going to trigger off a new phase in bitcoin adoption, amongst a new cohort of investors (retail and corporate treasurers) and it will probably send the bitcoin price mooning towards $100K in the next 6 months, but more on that in THIS ARTICLE. We’ve got to dig below the surface and untangle the narratives, though. Despite my conservative bias towards overvalued stocks, analysing tech from a bitcoin perspective causes me to be more positive about the prospects for all scarce assets as monetary authorities double down on their inflationary policies. There’s a shift in investing towards venture capital type investing in a highly speculative world, which is another framework that is useful to understand the current investment paradigm. Most importantly, its critical to understand the differences in these assets. Oversimplification could detract significant value and cause perpetual under-allocation to the most asymmetric investment opportunity of our lifetime.